Buying your first home is one of life’s most exciting milestones. I’ve worked with hundreds of first-time buyers here in Miami, and I know how overwhelming the process can feel at first. From understanding your mortgage options to choosing the right neighborhood, there’s a lot to think about.

The good news is, with the right plan and guidance, buying your first home in Miami can be smooth, rewarding, and even fun. My goal is to not only guide you through the steps but to make sure you feel confident every step of the way.

Miami isn’t just a city, it’s a lifestyle. Whether you’re drawn by the ocean views, our incredible food scene, or the investment potential, this city has something for everyone. In this blog, I’ll walk you through everything you need to know about buying your first home here. And if you want all my tools and checklists in one place, you can download my free Home Buyer Guide 2025 to help you stay organized.

Why You Need a Buyer’s Agent When Buying a Home in Miami

Many first-time buyers start by browsing listings on Zillow or Realtor.com and think they can go directly to the listing agent. Here’s the truth: the listing agent works for the seller, not for you. Their job is to get the seller the highest price and best terms.

That’s where I come in. As your dedicated buyer’s agent, I represent only your interests. Here’s what I bring to the table:

- Exclusive Representation: I fight for your goals, not the seller’s.

- Access to Pocket Listings: I can show you homes that never even hit the public market.

- Skilled Negotiation: From price to closing costs, I know how to make the deal work in your favor.

- Full Process Support: I handle the scheduling, paperwork, and deadlines so nothing slips through the cracks.

Want to know more about how I work with buyers? Learn more here

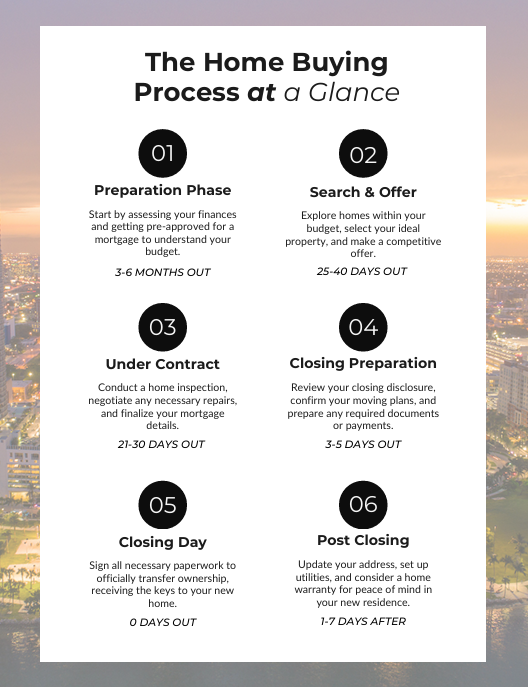

Buying a Home in Miami Step by Step

Buying a home is like running a marathon. There are multiple checkpoints along the way, and I’ll be with you at each one:

- Preparation Phase: We’ll assess your finances and connect you with trusted lenders for pre-approval.

- Search & Offer: We’ll tour homes together, narrow your options, and make a strong offer.

- Under Contract: I’ll guide you through inspections, appraisals, and escrow deposits.

- Closing Prep: Title searches, surveys, and loan approvals happen here.

- Closing Day: You’ll sign documents and get the keys.

Post-Closing: I’ll give you my moving checklist and local contractor referrals so you’re set up from day one.

Miami Mortgage Process for First-Time Home Buyers

The mortgage process can feel like a different language, but I’ll help translate it for you.

- Pre-Approval: This isn’t optional in Miami. With so much competition, sellers want to see proof you can afford the home. Pre-approvals are valid for 30–90 days.

- Down Payment: Most first-time buyers put down 5–7%, but programs exist that can help with as little as 3%.

- Lender Questions: Ask about rates, fees, mortgage insurance, and whether you qualify for assistance.

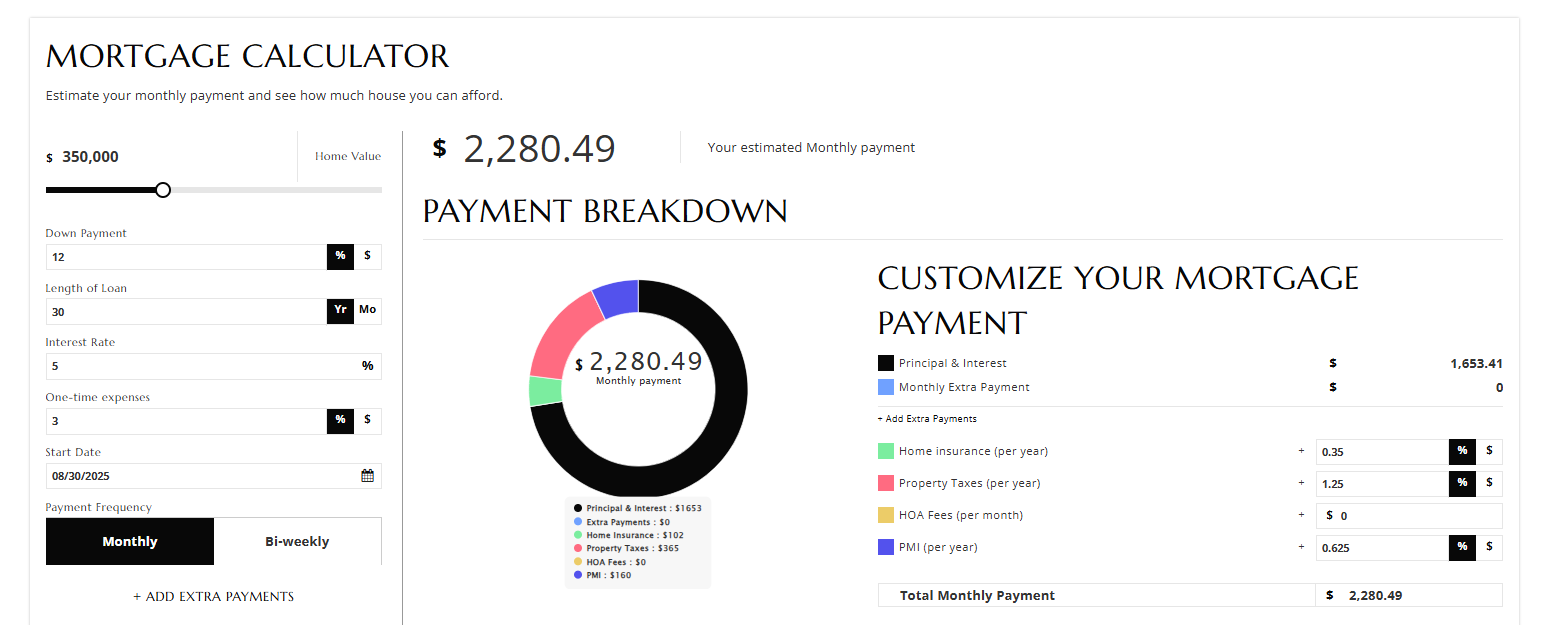

Try Mortgage Calculator to estimate your payments before we even tour your first home.

Stay informed with the latest Freddie Mac Mortgage Rates.

How to Define Wants vs. Needs When Buying a Home in Miami

It’s easy to get caught up in granite countertops or a pool with a waterfall, but as a first-time buyer, it’s important to separate your must-haves from your nice-to-haves.

- Needs: The essentials, like enough bedrooms, a safe neighborhood, or a manageable commute.

- Wants: The extras, like a walk-in closet or brand-new appliances.

Together, we’ll create a list that keeps you focused, so you don’t get distracted by staging or cosmetic details.

Miami House Hunting Tips and Showings Guide

Miami’s housing market moves fast, so being prepared is key. Here’s what I recommend:

- Keep Your Search Flexible: Overly strict filters online might make you miss great homes.

- Think Beyond Price: Homes listed $25k–$50k above your budget might be negotiable.

- Evaluate the Whole Property: Look at the lot size, structural condition, and resale value, not just finishes.

- Pay Attention to Location: Noise from highways or flight paths can affect your quality of life.

You can start your search today on my site: Browse Miami Homes for Sale.

How to Make a Strong Offer on a Home in Miami

Miami is one of the most competitive markets in the country. When you find the right home, you’ll need to move quickly and strategically. Here’s how I help you stand out:

- Submit a strong pre-approval letter.

- Put forward a clean offer with minimal contingencies.

- Match your offer price to recent comparable sales.

- Add a personal note to the seller to create connection.

These details often make the difference between winning and losing in a multiple-offer situation.

Home Inspections and Insurance in Miami: What First-Time Buyers Need to Know

Inspections are critical. Even a home that looks perfect can hide costly problems. In Miami, the most common inspections are:

- Standard Home Inspection ($300–$600)

- Four-Point Inspection: HVAC, plumbing, roof, and electrical systems.

- WDO Inspection: To check for termites and wood-destroying organisms.

You’ll also need Florida-specific insurance, including homeowners, flood, and windstorm coverage. Don’t worry, I’ll connect you with trusted providers so you can compare options.

Miami Home Closing Process and Moving Checklist

Closing day is the best day of the process. Here’s what happens:

- We’ll do a final walk-through to ensure everything is in good shape.

- You’ll sign your documents at the title company.

- Funds are transferred, and the keys are officially yours.

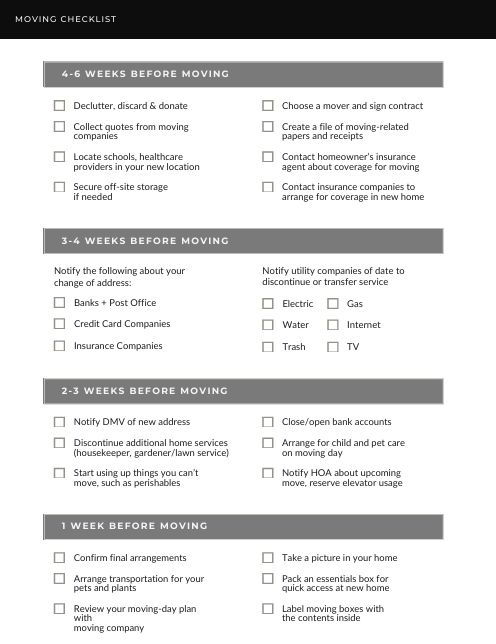

After that, my Moving Checklist will help you transfer utilities, update your address, and get settled into your new home. I’ll also share my list of trusted Miami contractors for anything from painting to landscaping.

First-Time Home Buyer FAQs in Miami

- How much should I save for a down payment?

Most first-time buyers put down 5–7%, but some programs allow as low as 3%. - Do I really need to get pre-approved first?

Yes, in Miami’s competitive market, pre-approval is essential. - What does “under contract” mean?

It means your offer has been accepted, but inspections and financing still need to be completed.

Download My Free Miami Home Buyer Guide

I created my Home Buyer Guide 2025 to walk you through every step of the process. Inside, you’ll find:

- Checklists for each stage of the process.

- A worksheet to define your wants vs. needs.

- A moving checklist.

- Lender questions you should ask.

Conclusion

Buying your first home in Miami doesn’t have to be intimidating. With the right agent, a clear plan, and a little patience, it can be one of the most rewarding experiences of your life. My role is to make sure you’re not just buying a house but investing in a future that fits your lifestyle and goals.

👉 Ready to start? Contact me today at Jose Muñoz Real Estate, try my Mortgage Calculator, or download my free buyer’s guide to get started.